I am Bishow Raut Chartered Accountant based in Nepal, dedicated to delivering top-notch accounting and financial solutions. With 07 years of experience in the industry, I have a proven track record of helping individuals and businesses achieve financial success. My expertise spans across various domains including tax planning, auditing, financial consulting, and more. I believe in building lasting relationships with my clients by providing reliable and transparent services.

Welcome to our discussion forum dedicated to exploring the various challenges and solutions within Nepal's financial sector. Here, you will find a comprehensive list of unresolved issues that we aim to address collaboratively. Our goal is to foster insightful conversations and generate innovative solutions to advance Nepal’s financial landscape. We invite you to contribute your expertise, share your perspectives, and work together to tackle these critical problems.

Procedure & Compliance for Foreign Company Registration in Nepal

This handbook provides a comprehensive guide for foreign companies intending to register and operate in Nepal. It outlines the procedures, compliance requirements, and key regulations.

Digital Service Tax in Nepal: Finance Act 2079/80 (2022/23)

Finance Act 2079/80 (2022/23) has introduced Digital Service Tax on Digital Services provided by Non-Resident Person to the Resident Consumers.

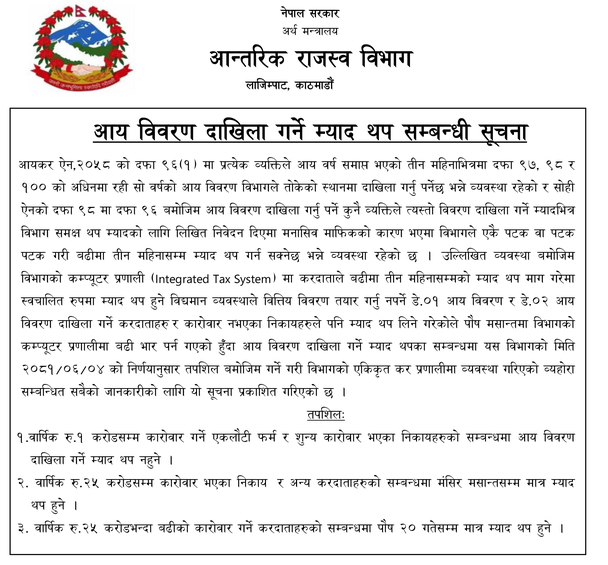

१. आय विवरण दाखिला गने म्याद थप सम्बन्धी सूचना

Want to keep more of your hard-earned money? I’m here to assist! As your personal financial advisor, I’ll collaborate with you to discover the best tax-saving strategies within the legal framework, ensuring you can enjoy more of your earnings without any stress. Together, we’ll navigate the financial landscape, making everything orderly and hassle-free. Whether it’s effective tax planning or reducing financial burdens, I’m here to support you every step of the way. Let’s make your money work smarter for you!

IT Audit Head

Finance Expert

Banking Expert

Pokhara Unit Head

Lawyer

Accountant

Account / Dolakha Branch

Audit Intern

OCR Department

Audit Team

Audit Team

Senior Advisor

Advisor

Advisor

Information Technology

Nepal follows the Nepal Financial Reporting Standards (NFRS), which are largely based on International Financial Reporting Standards (IFRS).

The fiscal year in Nepal starts on Shrawan 1st (mid-July) and ends on Ashad 31st (mid-July) of the following year.

Non-compliance with audit requirements can result in penalties, including fines, legal action, and disqualification of the company’s directors.

Yes, foreign companies can operate in Nepal, but they must comply with local accounting and audit standards, including the requirement to have their financial statements audited by a qualified auditor in Nepal.

Required documents include financial statements, tax returns, bank statements, ledgers, and other supporting documents that verify the accuracy of the financial records.

Internal audits should be conducted regularly, depending on the size and complexity of the organization, often quarterly or semi-annually.